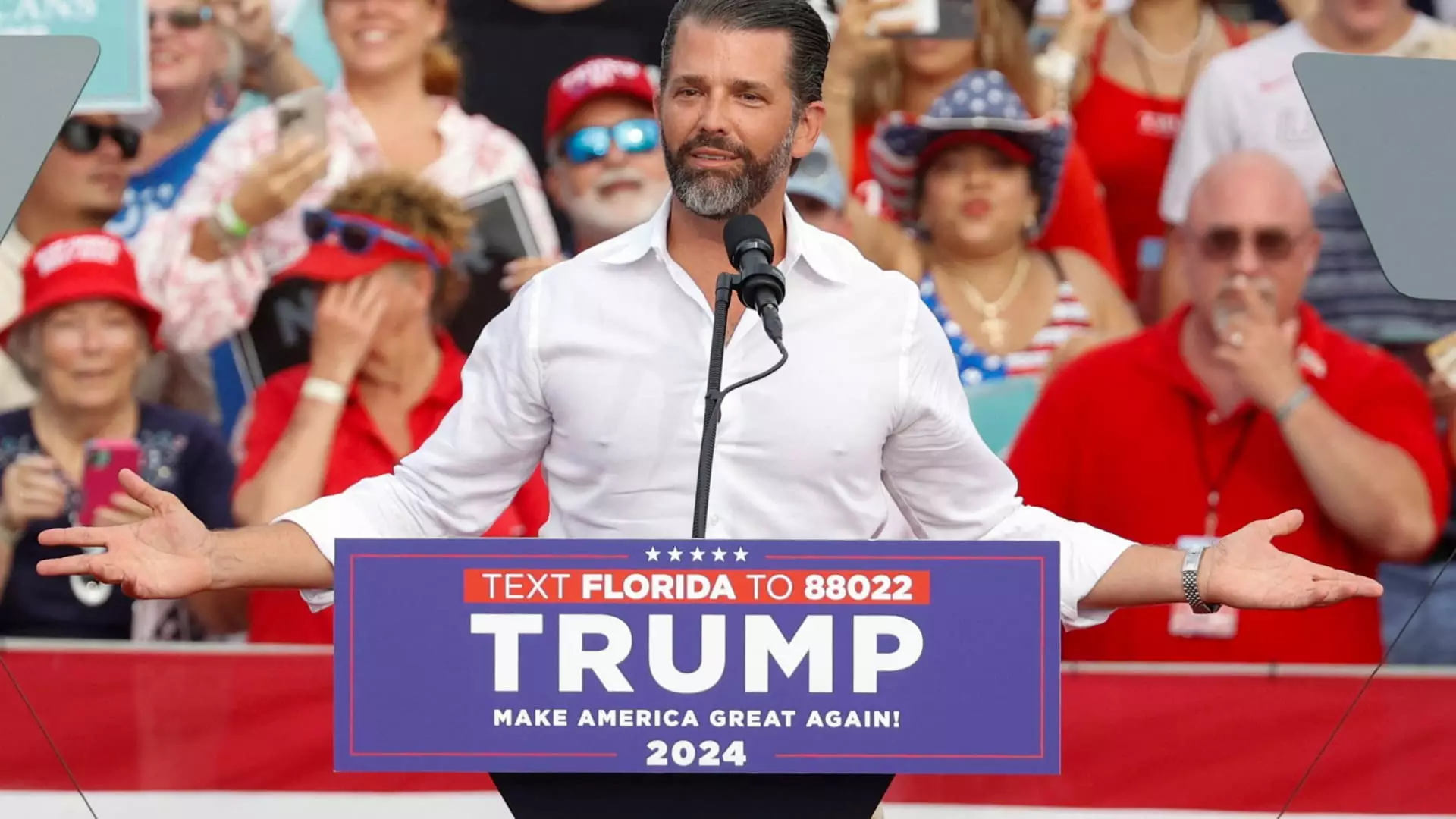

In the fast-paced world of finance, the influence of high-profile individuals on the stock market cannot be understated. This concept was brought sharply into focus when Donald Trump Jr. recently accepted a position on the board of PSQ Holdings, the parent company of PublicSquare, an online marketplace aimed at promoting values aligned with “life, family, and liberty.” Following the announcement, PSQ Holdings experienced a dramatic surge in share prices, evidencing the immediate impact that celebrity affiliations can have on market performance.

On the day of the announcement, shares of PSQ Holdings skyrocketed by 270.4%, reaching $7.63. Such a sharp increase in stock price, particularly for a microcap company with a market capitalization of merely $72 million, raises important questions about the relationship between board membership announcements and investor behavior. Investors often react impulsively to perceived validation from notable figures, which can lead to significant and sometimes unfounded price hikes. In the context of PSQ, the endorsement from Trump Jr. appears to have resonated strongly with potential investors who align with his public persona and the values of the company.

PSQ Holdings’ focus centers around establishing a “cancel-proof” economy, appealing to a segment of consumers concerned about censorship and the marginalization of conservative viewpoints. While their mission is noble, it raises questions about the company’s long-term viability. For instance, the firm reported net revenues of only $6.5 million against operating losses exceeding $14 million in their most recent quarter. This financial backdrop poses significant challenges in terms of sustainability and growth, regardless of celebrity involvement. Investors should exercise caution, recognizing that a share price spike does not necessarily reflect a company’s fundamental health.

The swift rise in PSQ Holdings’ stock price following Trump Jr.’s appointment aligns with a larger trend where celebrity endorsements significantly influence market dynamics. Trump Jr. isn’t merely a board member for PSQ; he has also joined other ventures, such as Unusual Machines and a conservative-focused venture capital firm. His repeated engagements with companies that align with political ideologies signal a burgeoning trend whereby celebrity influence extends beyond cultural domains and into the economic sphere. This intersection of celebrity and finance may lead to a more polarized market, where stock performance becomes increasingly tied to public sentiment linked to individual figures.

The recent events surrounding PSQ Holdings exemplify the volatile nature of the stock market, especially as it relates to high-profile board appointments. While the immediate impact of Donald Trump Jr.’s joining the board has garnered significant attention and spurred stock price increases, it is crucial for investors to remain prudent. Evaluation of underlying financial performances, rather than simply succumbing to hype, should guide investment decisions. While the allure of celebrity influence is potent, a comprehensive analysis will ultimately yield the most sound investment strategies in a rapidly shifting marketplace.