Contrary to conventional wisdom that places battery manufacturers as simple commodity producers, Contemporary Amperex Technology (CATL) is challenging that notion with bold new ambitions. The company’s trajectory towards becoming a comprehensive ecosystem provider signifies a strategic pivot from mere hardware manufacturing to creating a digital, AI-enabled infrastructure that sustains its dominance in the energy sector. Morgan Stanley analysts rightfully recognize that the future favors players capable of integrating hardware with intelligent, value-added software services. CATL is not just selling batteries; it’s building a sophisticated AI-powered monitoring system that enhances safety, optimizes performance, and offers continuous value to its clients.

This transition signals a profound understanding of the evolving energy landscape, where data, safety, and connected services increasingly influence procurement decisions. While many competitors remain focused on manufacturing batteries at the lowest cost, CATL aims to embed itself within a broader technological ecosystem that leverages artificial intelligence to improve safety standards, optimize logistics, and foster long-term collaborations. This shift elevates CATL from a mere supplier to a pivotal stakeholder in the global green revolution—a development that could profoundly alter the competitive balance.

Implications of Valuation and Market Confidence in CATL

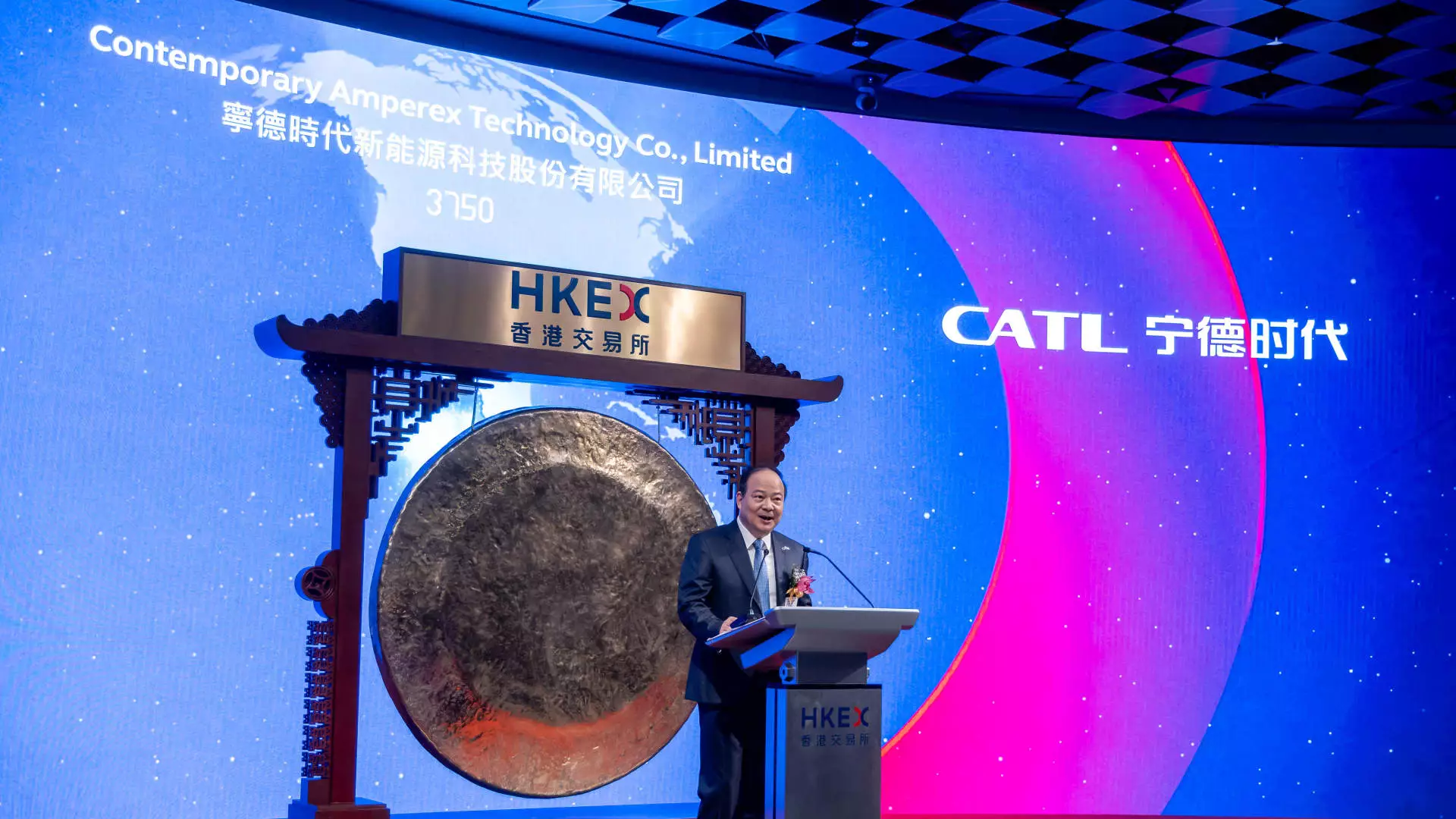

Market confidence in CATL’s future is reflected in rising share prices and optimistic analyst forecasts. The recent increase in the target price by Morgan Stanley—from HKD 390 to HKD 445—underscores a strong belief that the company’s innovative approach will unlock substantial value. This optimism isn’t unfounded, given the company’s impressive IPO performance, making it one of the largest in 2025, and its strategic positioning in the demanding European and Indonesian markets.

Yet, there is an underlying tension between growth prospects and geopolitical uncertainties. The discount on mainland-listed shares compared to Hong Kong counterparts highlights lingering concerns about political and regulatory risks. The company’s aspirations in Europe—massively funding expansion into Hungary—are crucial in establishing resilient revenue streams that are seemingly less susceptible to U.S.-China tensions. Its ventures into Indonesia for nickel mining and processing further illustrate its desire to diversify supply chains and reduce dependency on volatile geopolitical arenas. These moves shine a spotlight on CATL’s meticulous balancing act: expanding global influence while navigating a complex and often antagonistic international arena that could threaten its core operations.

U.S. Political Pressures and the Strategic Calculus

The U.S. government’s outright designation of CATL as a “Chinese military” entity—despite the company’s repeated denials—introduces a significant obstacle. The ban on Pentagon procurement starting in 2026 exposes CATL to the risk of being marginalized from one of the world’s largest markets for electronics and energy infrastructure. While analysts suggest the risks are already priced into the stock, the reality is more nuanced: such geopolitical headwinds threaten to stifle the company’s strategic expansion in critical markets and undermine investor confidence.

This political arena underscores a broader contest for technological supremacy, where battery manufacturing is only the starting point. Control over emerging ecosystems that incorporate AI, data analytics, and safety monitoring becomes a matter of national security. CATL’s efforts to secure licensing deals, such as with Ford, are tactical moves that help hedge geopolitical risk. However, reliance on foreign partnerships and licensing agreements highlights the vulnerability of Chinese tech firms in a bifurcated global landscape increasingly driven by national security concerns.

Strategic Alliances and the Future of Electric Vehicle Powerhouses

Despite the geopolitical challenges, CATL’s strategic alliances underscore its resilience. Collaborations with automakers like Xiaomi and Zeekr point toward a future where battery technology becomes a core component of integrated vehicle ecosystems. The use of CATL’s “Freevoy Super Hybrid Battery” in Zeekr’s upcoming hybrid SUV exemplifies how traditional automotive powertrains are being reshaped by innovative battery systems tailored for hybrid vehicles—a segment that bridges the gap toward full electrification.

Furthermore, the potential influx of licensing revenue from Ford’s planned battery plant signals a shift toward monetizing technological expertise, a move likely to bolster profitability over the long term. Although profits from these licensing agreements will only materialize at scale around 2027, the strategic foresight to lock in such partnerships now is a hallmark of CATL’s approach to sustain long-term growth in a highly competitive industry.

The Broader Geopolitical and Market Stakes

Ultimately, CATL’s trajectory embodies a nuanced interplay between technological innovation, strategic expansion, and geopolitical risk management. The company’s efforts to dominate not just the battery supply chain but also the surrounding digital ecosystem position it as a pivotal player in shaping the future of energy and transportation. While the risks associated with U.S. sanctions and geopolitical tensions cannot be dismissed, CATL’s proactive diversification efforts—especially in Europe and Southeast Asia—reflect a center-right emphasis on pragmatic resilience and strategic independence.

In a world where energy sovereignty is increasingly intertwined with national security and economic power, CATL’s moves could become a blueprint for other global players. Its ability to navigate complex international waters while pushing frontiers in AI-enabled battery safety and ecosystem integration offers a glimpse into the future of strategic dominance—an arena where technological superiority often eclipses overt political influence.

In sum, CATL’s bold ambitions may well redefine the global energy order, positioning itself at the crossroads of industrial innovation and geopolitical strategic calculus. Its journey will undoubtedly be fraught with challenges, but one thing remains clear: the company is no longer just a battery maker—it’s an emerging geopolitical force with the potential to reshape the energy landscape on a global scale.