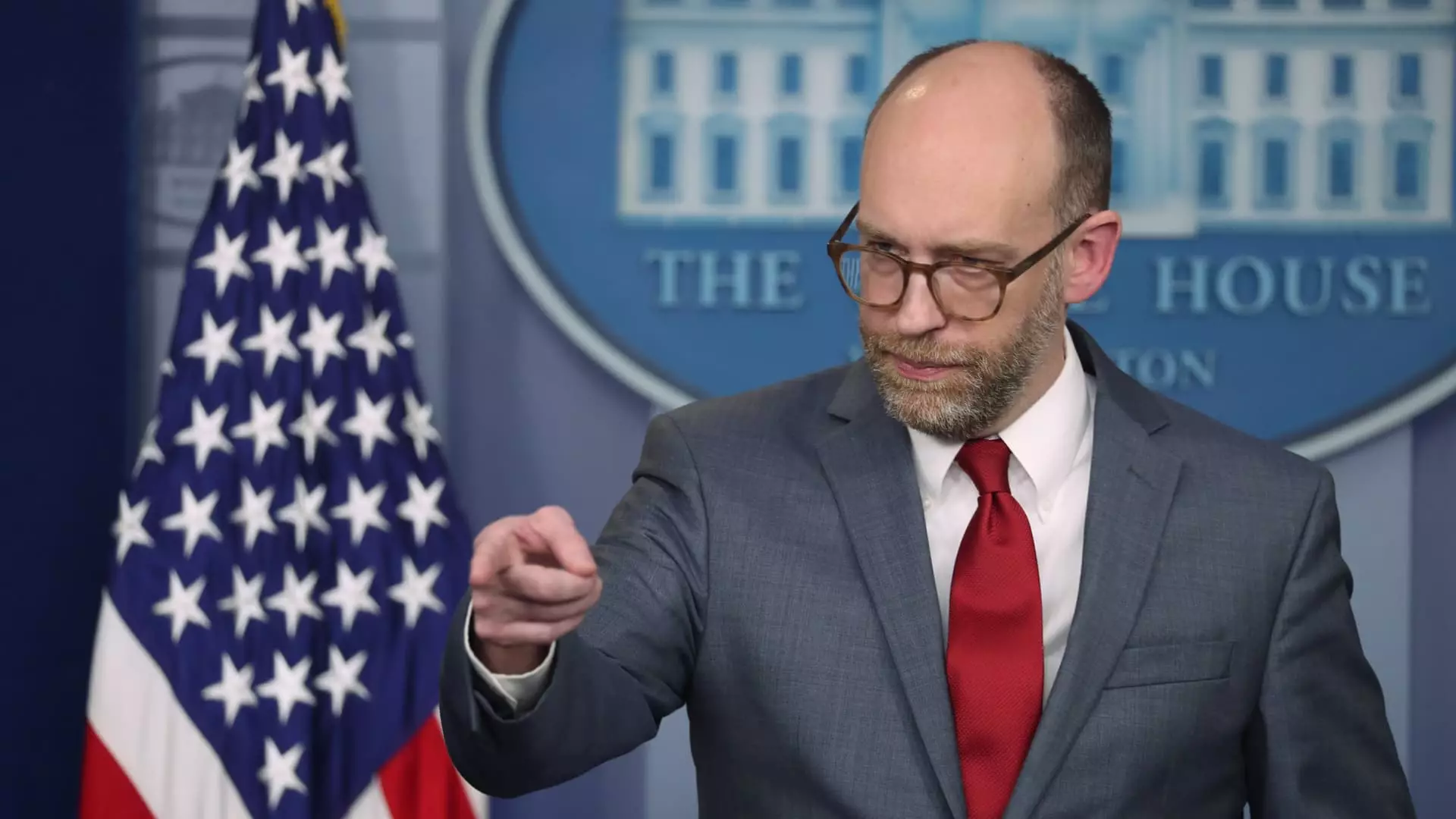

In a striking turn of events, the Consumer Financial Protection Bureau (CFPB) faces an unprecedented challenge that has prompted its employees to transition to remote work. This shift in operational dynamics was announced in a memo from Chief Operating Officer Adam Martinez, confirming that the agency’s Washington, D.C. headquarters will remain closed until February 14. The announcement follows a directive from newly-appointed acting CFPB director Russell Vought, instructing the suspension of nearly all regulatory activities, including the oversight of financial institutions. This drastic move highlights increasing concerns regarding the bureau’s future under new leadership with ties to controversial figures in the tech industry.

The backdrop to the CFPB’s turmoil includes the unexpected involvement of operatives linked to Elon Musk’s DOGE, who reportedly gained access to sensitive CFPB data, including performance reviews of agency staff. Considering Musk’s previous criticisms of the agency, including calls for its dissolution, this intrusion raises alarms among employees and stakeholders alike. The implications are profound—not only for the morale of the workforce but also for the integrity of the CFPB’s regulatory framework. Vought’s issuance of a halt to fresh funding further accentuates this existential crisis, with his remarks on social media hinting at an aggressive push towards institutional reorganization.

Within the CFPB, anxieties are palpable as employees prepare for potential administrative leave or, worse, layoffs—a scenario reminiscent of drastic measures taken against other federal agencies under previous administrations. Even though the CFPB boasts a workforce of approximately 1,700 employees, it’s noteworthy that only a minority of these positions are legally mandated, signaling that large-scale layoffs could significantly undermine the bureau’s crucial mission. This mission, grounded in protecting consumers from predatory practices post-2008 financial crisis, is at risk of degenerating into a skeleton of its former self.

At the heart of this institutional upheaval lies the CFPB’s critical function in advocating for consumer rights, particularly in the financial sector. The bureau is responsible for the implementation of rules and regulations designed to prevent exploitative practices by banks and other financial entities. Initiatives aimed at capping credit card fees, managing overdraft charges, and alleviating the financial burdens of medical debt stand to save consumers billions of dollars. The ongoing efforts to disentangle misinformation surrounding such practices are essential for maintaining public trust in financial institutions.

Reactions from financial industry stakeholders further complicate the CFPB’s landscape. Various bank trade associations have long regarded the CFPB as overly aggressive and have historically combated its regulations in court, even challenging the agency’s constitutional validity. The current uncertainty surrounding the CFPB may embolden financial groups to ramp up their opposition efforts, potentially dismantling regulations that protect consumers and aid in maintaining a fair marketplace. This could lead to a situation where unregulated practices reemerge, ultimately jeopardizing the very consumers the agency aims to safeguard.

As the CFPB braces for a future that remains uncertain, the agency would face critical challenges in preserving its operational integrity and mission. The ongoing involvement of figures like Vought and Musk demonstrates a broader trend of politicization within regulatory agencies which could result in further disarray. If justice and accountability within the financial services sector are to remain intact, renewed focus on consumer protection must prevail. The next steps taken by agency leadership, in navigating both internal and external pressures, will be influential in shaping the future of the CFPB and consumer financial rights in America.

While the tumultuous changes at the CFPB present unprecedented challenges, they also spotlight the ongoing importance of advocacy in consumer finance. The legacy of the agency, built on the foundations laid after the financial crisis, hangs in the balance, as stakeholders closely monitor how these events will unfold in the coming months.