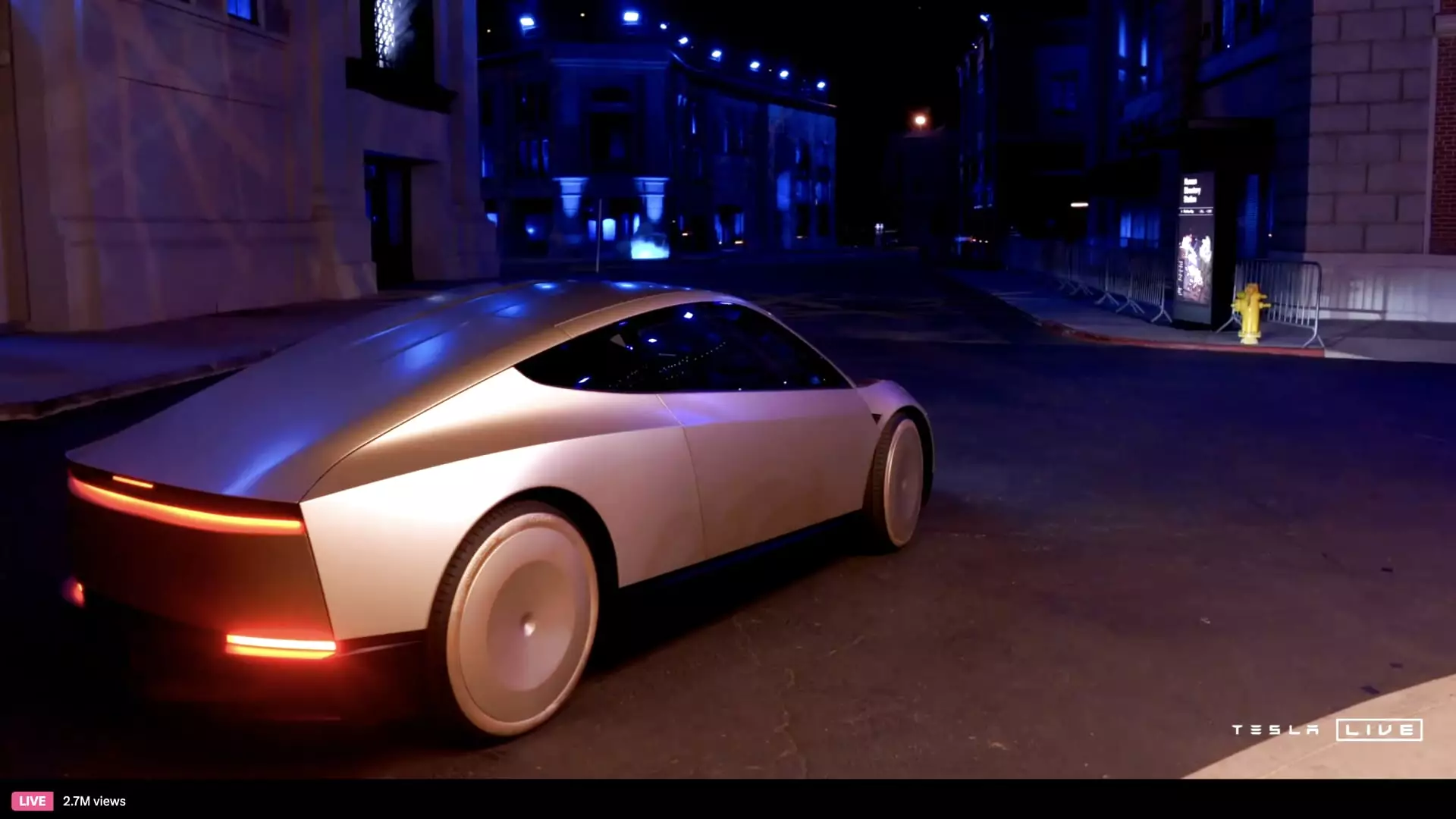

Tesla’s recent showcase of its Cybercab has ignited substantial discussions across the automotive and tech sectors, yet it appears that investor enthusiasm has dwindled significantly. The long-anticipated robotaxi event, presided over by CEO Elon Musk, featured the unveiling of a flashy, silver two-seater vehicle that boasts no steering wheel or pedals. While the design appears futuristic, investors initially greeted the reveal with skepticism, leading to a notable dip in Tesla’s stock price—down by approximately 5.8% in premarket trading.

Musk’s ambition for the Cybercab is evident, with aspirations of having the vehicle fully autonomous and ready for production by 2027. However, the absence of concrete manufacturing details and a lack of transparency regarding the Cybercab’s operational capabilities left many investors and analysts unsatisfied. Musk stated that the vehicle would be priced below $30,000, ostensibly to attract a broader market segment, yet this claim has also raised eyebrows regarding profit margins and production costs.

A focal point during the event was Musk’s mention of significant advancements in Tesla’s Full Self-Driving (FSD) capabilities, with expectations for “unsupervised FSD” functionality to roll out in Texas and California next year. However, the context surrounding this announcement was somewhat ambiguous. The current version of FSD has faced criticism for requiring a human driver to remain alert and ready to intervene at any moment—quite a far cry from the fully autonomous experience that many consumers expect.

Analysts from Barclays captured this sentiment succinctly, expressing that the Cybercab presentation failed to deliver any immediate innovations or upgrades related to FSD technology. Instead, they characterized the event as a reiteration of Musk’s grand vision for the future of autonomous vehicles without delivering actionable insights or capturing the short-term potential that investors eagerly crave.

The overall response from institutional investors reflects a growing frustration with Tesla’s strategy and the communication surrounding its future developments. Analysts from Piper Sandler articulated that trading firms reliant on immediate results would likely view the robotaxi introduction as underwhelming. Predictions of further stock sell-offs in the weeks following the event suggest a market increasingly wary of Tesla’s capacity to deliver timely advancements or financial performance.

Morgan Stanley offered a critical analysis as well, indicating that Musk neglected to present Tesla as a formidable player in the AI domain, despite his visionary aspirations. Without detailed insights on FSD enhancements or strategic collaborations—such as the speculated partnership with Musk’s other organization, xAI—analysts express skepticism about the company’s trajectory in a competitive landscape that is rapidly evolving.

As the public grapples with the implications of self-driving technology, regulatory bodies continue to prioritize safety concerns over rapid deployment. This cautious approach poses a significant barrier to the commercialization of autonomous vehicles, regardless of how advanced companies like Tesla proclaim their technologies to be. Notably, Waymo, owned by Alphabet Inc., remains one of the few companies to effectively launch a robotaxi service, showcasing the challenges that Tesla and other competitors must overcome to gain widespread acceptance.

The implications of this reality cannot be overstated. Investors are keenly aware that the journey toward fully autonomous vehicles is fraught with regulatory hurdles, technical challenges, and public scrutiny. Musk’s robotaxi event, despite its innovative aspirations, may ultimately reflect a disconnect between ambitious projections and the immediate expectations of investors who are looking for reassurance in an uncertain market.

Tesla’s recent robotaxi event precipitated a marked decline in investor confidence, fueled by a perceived lack of substance and actionable insights. The road to widespread acceptance of autonomous vehicles remains convoluted and protracted. Tesla’s journey underscores the ever-present tension between visionary goals and the necessity for tangible results. Moving forward, for Elon Musk and Tesla, the challenge will be to align their ambitious aspirations with the practical realities of the marketplace, ensuring that both innovation and investor sentiments are addressed in a timely manner.