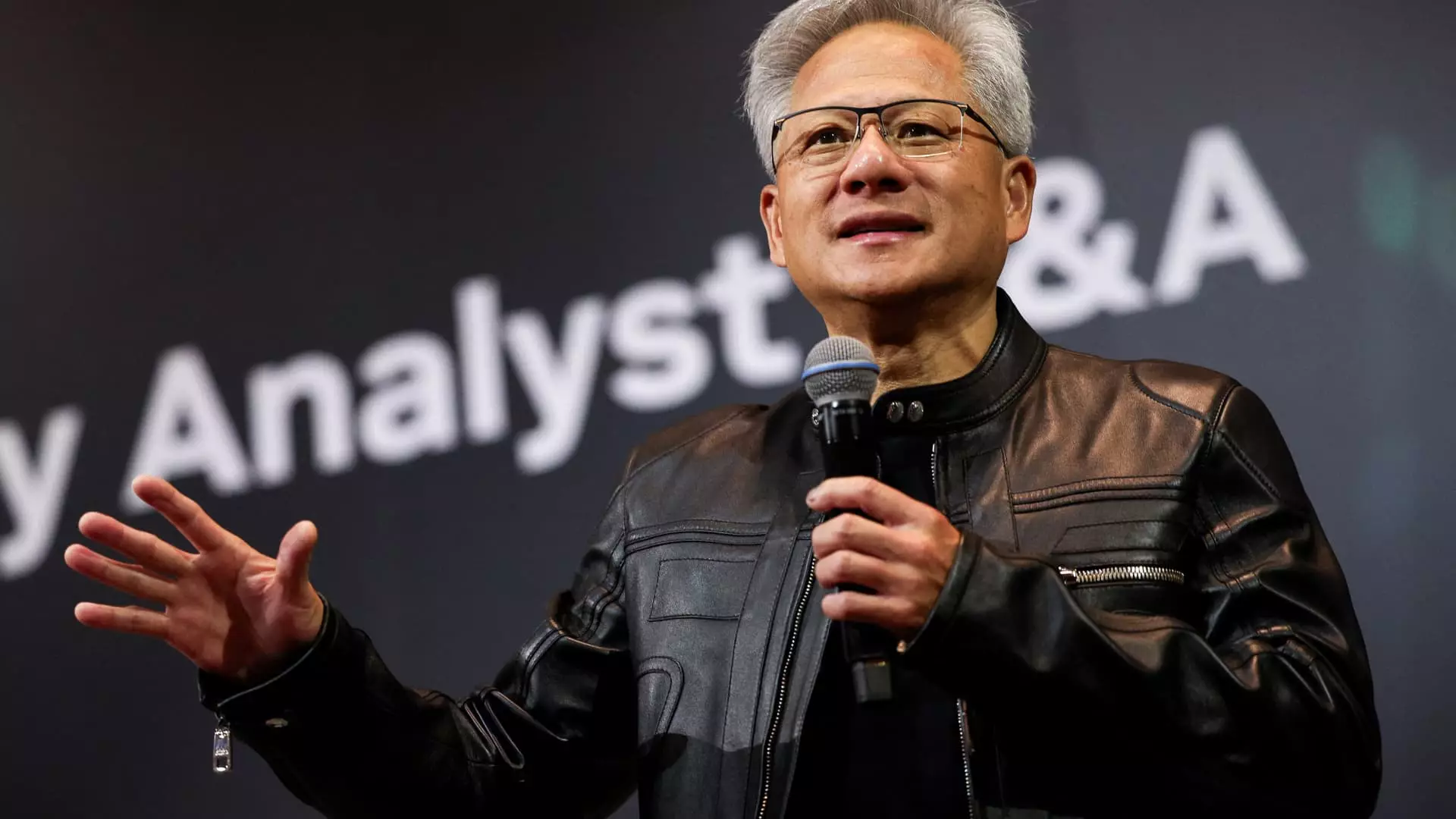

Nvidia’s CEO, Jensen Huang, recently made headlines with a series of substantial stock sales, totaling over $50 million within just a few days. While corporate insiders often sell shares under pre-established plans, the scale and timing of Huang’s sales cannot be dismissed as mere routine. In a market clouded with volatility and geopolitical tensions, such high-profile sell-offs demand scrutiny. They cast doubts on the confidence of leadership amid Nvidia’s astronomical growth driven by surging AI demand. From an investor’s perspective, Huang’s sale raises essential questions about the company’s future trajectory: does this demonstrate a lack of conviction, or is it simply savvy fiscal planning?

This massive liquidity event, especially given the recent stock upticks, could be perceived as hedging against unforeseen risks or a sign that insiders believe the stock has reached an inflection point. While insiders are permitted to sell under SEC rules, the optics of such large transactions hold weight for shareholders. It’s critical to ask if Huang’s sales reflect internal confidence or if they subtly hint at potential turbulence on the horizon, particularly considering geopolitical hurdles such as the U.S.-China chip export restrictions.

Geopolitical Risks and Strategic Moves in the Global Chip War

Adding complexity to Nvidia’s narrative is its delicate geopolitical balancing act. The company’s decision to resume sales of its H20 chips to China lingers amidst U.S. government negotiations. Nvidia’s hope to sell advanced chips to China highlights its willingness to navigate murky waters, exposing itself to both lucrative markets and potential political backlash. During a turbulent period characterized by strict export controls and shifting diplomatic alliances, Nvidia’s stance signifies a pragmatic yet risky approach.

Huang’s assertion about future sales of cutting-edge chips to China suggests confidence in the company’s ability to operate within the evolving regulatory landscape. Still, such ambitions come with undeniable geopolitical risks. A misstep or further tightening of export restrictions could jeopardize Nvidia’s growth trajectory and hurt its stock value. The company’s strategic pivot to gain U.S. government approval underscores the fragile nature of conducting business at the intersection of innovation and geopolitics—an area where many American tech giants are increasingly vulnerable.

The Market’s Center-Right Liberal Perspective: Trust and Caution amidst Growth

From a balanced, center-right liberal standpoint, Nvidia’s recent stock sales and international maneuvering influence confidence in the company’s prospects. While the company’s innovation and market dominance are undeniable, the sizeable insider sales signal a need for caution. It’s easy to get swept up in the excitement of Nvidia’s market valuation soaring past $4 trillion, yet this rapid ascent is underpinned by geopolitical uncertainties and internal leadership decisions.

Smart investors recognize that a healthy skepticism is necessary when an industry leader’s executive team begins liquidating shares at such an extraordinary scale. It doesn’t mean disaster is imminent, but it does warrant a conservative outlook—prioritizing stability and prudent risk management amid a volatile global landscape. Moreover, Nvidia’s strategic efforts to hold onto lucrative markets like China demonstrate both entrepreneurial resilience and vulnerability—two sides of the same coin in today’s complex international climate.

While innovation remains key, the recent actions by Huang suggest that, even at the pinnacle of success, tensions—be they market, political, or regulatory—remain potent forces capable of reversing the current euphoria. For center-right leaning observers, this calls for a cautious optimism: celebrating the company’s achievements while vigilantly monitoring the geopolitical and leadership signals that could threaten its long-term stability.