Eli Lilly has taken significant steps to enhance the accessibility of its weight loss drug, Zepbound, particularly for individuals without insurance coverage. On Tuesday, the company announced the rollout of higher doses in single-dose vials at significantly lower prices than their usual monthly rates. This adjustment is part of a broader initiative aimed at meeting the increasing demand for Zepbound amid growing concerns regarding obesity and related health issues in the U.S.

The introduction of single-dose vials, particularly for those under Medicare and other insurance plans that do not cover obesity treatments, marks a pivotal shift in Lilly’s approach to healthcare. The weight loss drug’s usage has been expanded recently, as it has been approved for administration in patients with obesity and those diagnosed with obstructive sleep apnea. Given these new parameters, the strategy not only aims to increase the patient base but also ensures that individuals receive the actual medication rather than potentially harmful compounded alternatives.

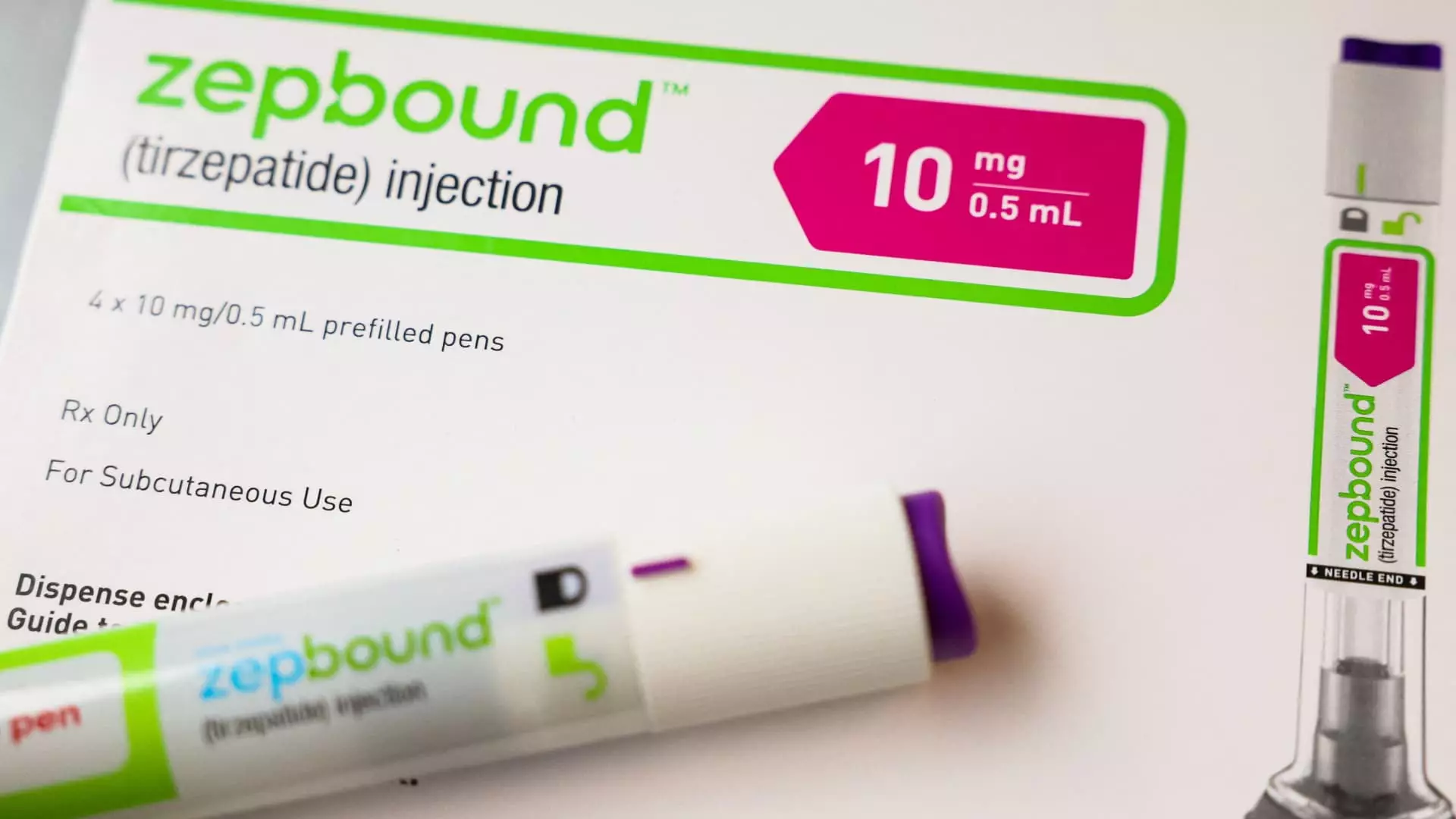

The new pricing strategies reflect Eli Lilly’s commitment to making Zepbound more accessible. Patients can now purchase 7.5 milligram and 10 milligram vials for $499 per month when filling their initial prescription or any refill within 45 days; subsequent purchases will see a slight increase in cost. The company has also reviewed the prices for its lower-dose options, cutting them by $50 each. The 2.5 milligram vial will now sell for $349, while the 5 milligram version will be available for $499.

These changes aim to relieve the financial burden on many patients who are self-paying, especially those enrolled in Medicare and employer-sponsored plans that do not recognize obesity medications. Patrik Jonsson, the president of Eli Lilly’s diabetes and obesity division, articulated a crucial aspect of this initiative: making therapies affordable for a population often left without proper coverage.

One of the critical challenges remains the requirement for patients to draw the medication using syringes and needles from the single-dose vials, a more cumbersome process compared to the user-friendly autoinjector pens currently on the market. However, the manufacturing process of vials is considered more efficient, allowing for quicker scaling of supply to meet the rising demand for Zepbound.

The changing regulations surrounding obesity treatments highlight a growing recognition of the condition as a chronic disease rather than a simple issue of lifestyle choice. Although Zepbound has gained approval, its coverage under traditional Medicare plans remains a gray area. Jonsson emphasized that despite some skepticism among health officials regarding weight loss drugs, Eli Lilly is advocating for actions that would lead to broader insurance acceptance for obesity medications.

As the market adapts, the widespread practice of patients turning to compounded versions of Zepbound, due to its previously high costs, has begun to wane. The U.S. Food and Drug Administration’s declaration that the Zepbound shortage is now over has spurred these changes. Eli Lilly has made it clear they are not engaged in a pricing war with compounders, but rather, they are working diligently to ensure that patients have access to a safe, FDA-approved treatment.

Eli Lilly’s LillyDirect platform represents a bold move towards direct-to-consumer healthcare options. Launched in January, this initiative facilitates connections between patients and telehealth services that can prescribe Zepbound if deemed appropriate. The model not only offers home delivery for prescribed medications but also integrates with third-party pharmacies to ensure seamless patient access.

Despite the potential for innovative advancements, the company has reported that a modest percentage of the broader obesity treatment market is currently utilizing LillyDirect. Nevertheless, the introduction of the new dosing options is expected to drive higher engagement.

The upcoming partnership with health-care startup Ro to offer single-dose vials through its platform is another promising avenue that could bolster Eli Lilly’s market presence. It exemplifies the potential shifts within healthcare that prioritize patient-centric solutions, tech integration, and affordability in treating chronic conditions like obesity.

Eli Lilly’s recent changes regarding Zepbound underscore a proactive shift in addressing the multifaceted challenges surrounding obesity management. With enhanced accessibility through affordable pricing and new dosing options, Eli Lilly seeks to reshape perceptions and realities surrounding treatment. The overarching goal is clear: to provide patients with effective, FDA-approved medications while advocating for systemic policy changes that facilitate broader medication coverage. In navigating this complex landscape, Eli Lilly has positioned itself as a key player in the ongoing battle against obesity in the United States.