The stock market can often resemble a turbulent sea, with various winds of news pushing and pulling prices in unexpected directions. Recently, several companies have distinguished themselves by either gaining or losing ground significantly in midday trading. This article examines some of the notable movers, providing insights into their current positions and future outlooks.

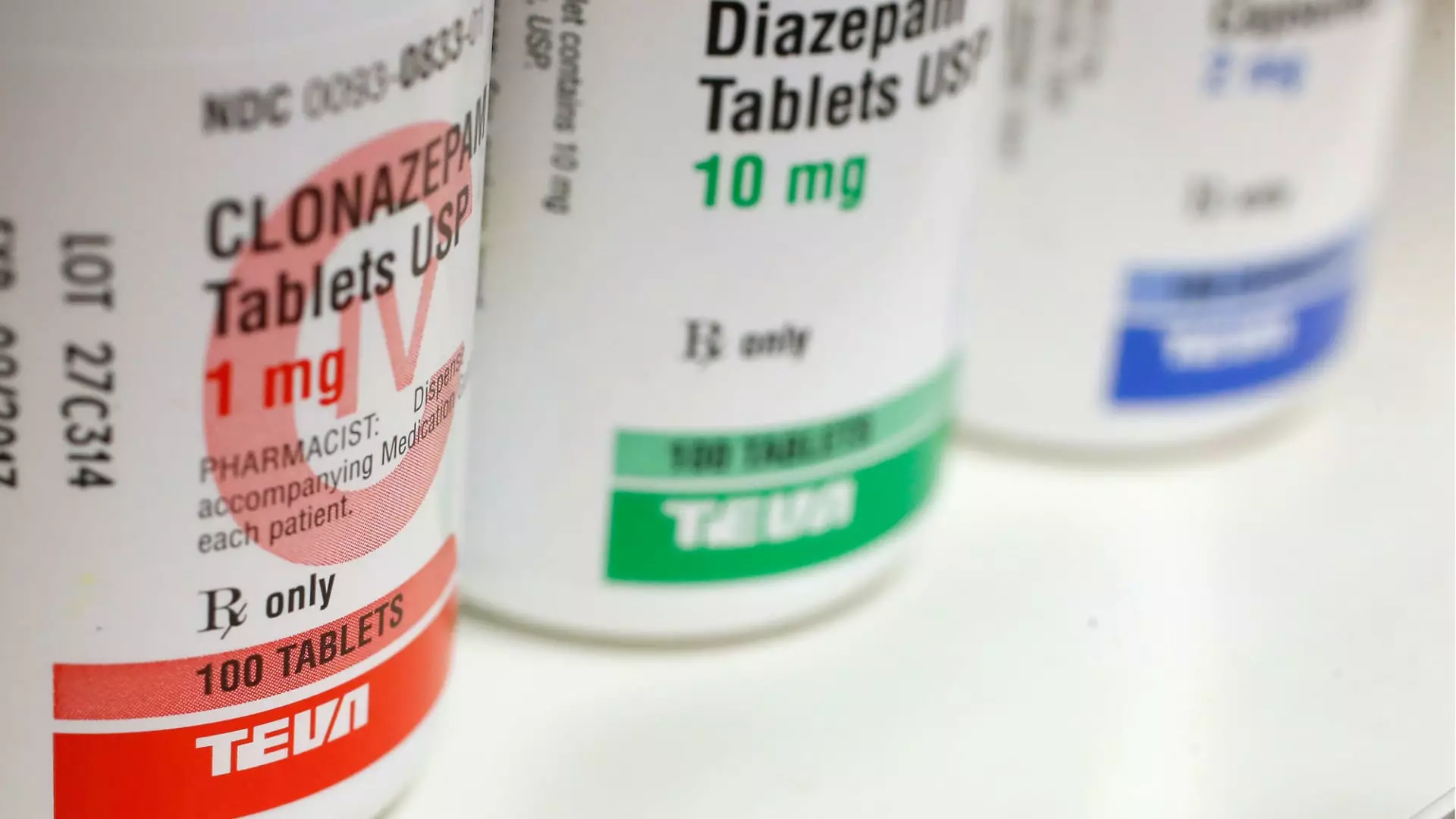

Teva Pharmaceuticals and Sanofi captured investor attention with their remarkable stock climbs of over 23% and 6%, respectively, after sharing promising Phase 2b results for their collaborative treatment, duvakitug, aimed at addressing moderate to severe inflammatory bowel disease (IBD). This success comes at a time when the pressure for innovative solutions in the healthcare sector is mounting. Investors are likely reacting not just to the immediate results but also to the potential for these treatments to tap into lucrative markets. The breakthrough exemplifies how pharmaceutical partnerships can cultivate significant advancements and influence share prices positively.

In another instance of robust performance, Pfizer’s stock rose approximately 4% after the biopharmaceutical giant released its 2025 revenue projections. By forecasting revenues between $61 billion and $64 billion—aligning closely with the consensus estimate—Pfizer has managed to alleviate investor concerns surrounding its future prospects. In an industry often characterized by fluctuations due to regulatory issues and competition, such stability is invaluable. These figures indicate that investors can expect solid performance based on existing drugs and advancing pipelines.

Quantum Computing experienced a striking surge of over 38%, reaching a new 52-week high after securing a significant contract with NASA. The collaboration promises to revolutionize advanced imaging and data processing, emphasizing the growing intersection of technology and scientific exploration. Quantum’s cutting-edge entropy quantum optimization machine, known as Dirac-3, appears to be a game-changer for contractors seeking edge in competitive opportunities. This development also highlights the increasing importance of quantum technology and positions Quantum Computing as an essential player in diverse industries.

The clean energy sector has also seen considerable activity, epitomized by SolarEdge Technologies’ rise of 21%. This uptick followed a notable double upgrade from Goldman Sachs, which shifted SolarEdge’s rating from ‘sell’ to ‘buy’. The bank has identified 2025 as a pivotal year for the company’s recovery and transformation. As global focus intensifies on renewable energy solutions, companies like SolarEdge that are well-prepared for scaling operations could see substantial benefits moving forward.

Contrarily, Red Cat, a drone technology company, saw its shares tumble by 12%, posting worse-than-expected losses for the fiscal second quarter. Despite earlier optimism sparked by speculative drone sightings in New Jersey, this decline signifies the volatility often present in emerging tech companies. Investors are typically jittery when earnings do not meet or exceed expectations, leading to heightened scrutiny of Red Cat’s operational strategies.

Market dynamics are further complicated by movements among key tech firms. Nvidia and Broadcom’s stocks dropped by more than 1% and nearly 5%, respectively, illustrating the mixed sentiment surrounding chip stocks. Nvidia, transitioning into correction territory, reflects broad market concerns about future growth amidst stiff competition. Conversely, Broadcom enjoyed a robust week, propelled by better-than-expected fourth-quarter earnings and a market cap surpassing $1 trillion. This cycle illustrates the inherent risks and rewards in the technology sector amid fluctuating economic indicators.

Other companies such as Tesla and Manchester United have also made notable moves in midday trading, with Tesla climbing 1% on bullish expectations fueled by regulatory changes, while Manchester United’s shares jumped 2% upon receiving a new buy rating from UBS. Both instances showcase how external factors, such as regulatory environments and expert ratings, can significantly affect stock trajectories.

Overall, the midday trading landscape is vividly dynamic and instructive. Understanding the rationale behind stock movements—whether through partnership successes, earnings disappointments, or fundamental market shifts—provides invaluable insights for investors striving to navigate this complex environment. The interplay of these various factors ultimately shapes the market landscape in a myriad of fascinating ways.