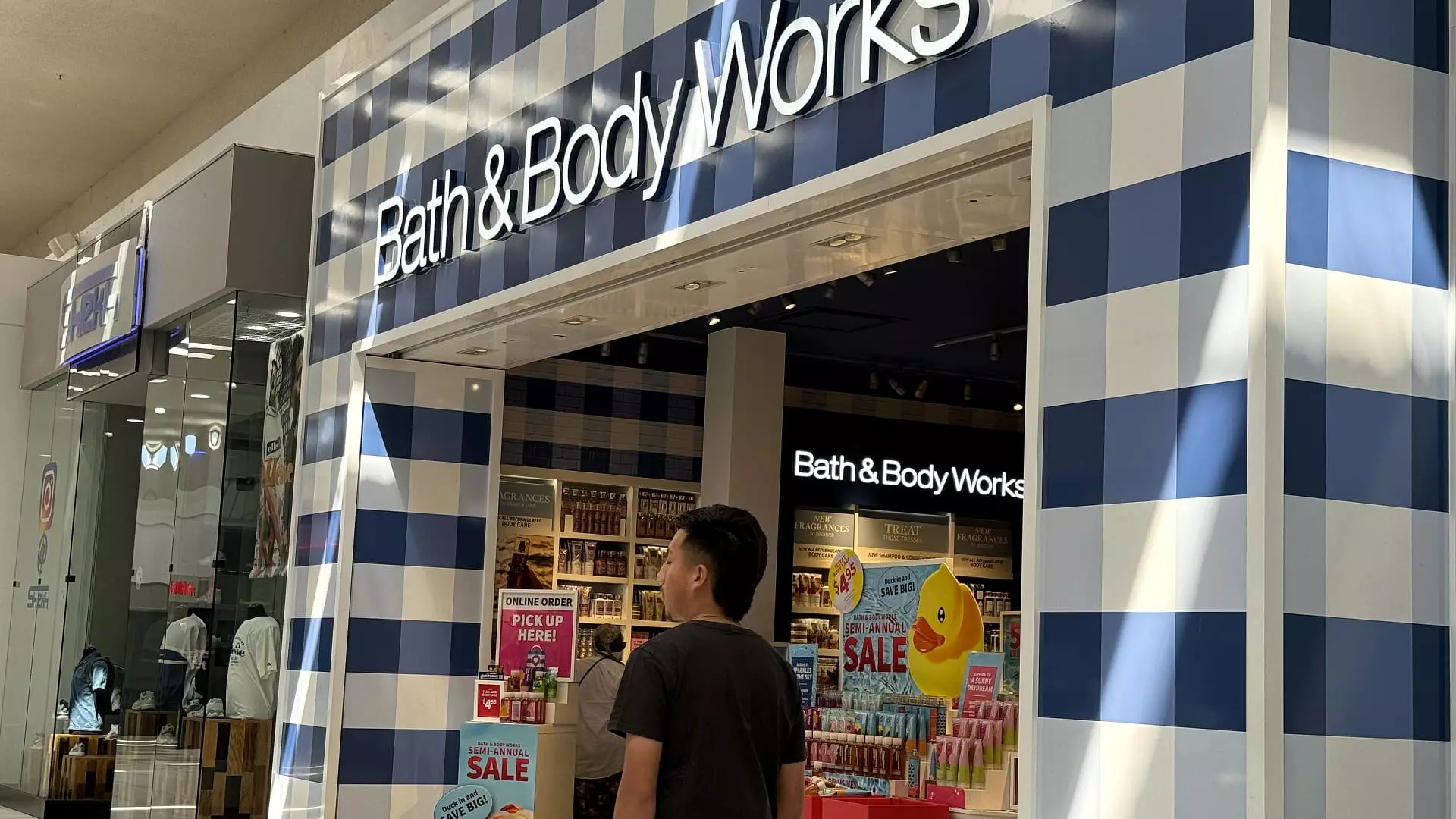

In the world of finance, the premarket session often serves as a precursor to the day’s trading trends, and today was no exception. One standout was Bath & Body Works, which witnessed its shares surge by an impressive 16%. This leap came in direct response to its third-quarter earnings, which outperformed expectations set by Wall Street analysts. The retailer reported earnings of 49 cents per share, exceeding the anticipated 47 cents, alongside revenues of $1.61 billion—also surpassing the forecast of $1.58 billion. This performance not only highlights Bath & Body Works’ strong market presence but also underscores consumer demand in a competitive retail environment.

However, the movement was not confined to just one sector. Robinhood’s shares experienced a boost of over 7%, following a notable upgrade from Morgan Stanley. This shift from equal weight to overweight suggests that analysts have increased confidence in Robinhood’s growth potential, particularly in light of anticipated market activity post-election, where heightened trading in stocks and anticipated changes in cryptocurrency regulations are expected to spur revenues further.

On a less positive note, Macy’s encountered turbulence as its shares dipped by 3%. The retailer disclosed the postponement of its official third-quarter results after an internal investigation revealed that an employee had manipulated accounting entries to obscure delivery expenses, amounting to discrepancies between $132 million and $154 million over several years. Fortunately for Macy’s, the company assures stakeholders that these accounting issues will not impact its cash flow. Nevertheless, such revelations often lead to a loss of investor trust, which can have longer-term implications for stock performance.

Abercrombie & Fitch saw a modest increase of 3%, buoyed by anticipation for its upcoming earnings report, which is due shortly. Analysts predict earnings of $2.39 per share on revenues of approximately $1.19 billion, reflecting strong performance from both Abercrombie and its subsidiary Hollister. Investor sentiment has shifted positively for apparel retailers as well, spurred by Gap’s uplifting announcements regarding its holiday season outlook, indicating a potentially robust shopping season ahead.

Target is another company that caught analysts’ attention with its stock increasing nearly 2%. Oppenheimer listed it as a top pick, pointing out its favorable risk-to-reward ratio. Despite experiencing a decline of roughly 12% this year, the stock’s dividend yield remains appealing to investors seeking steady returns in a volatile market.

Finally, firms like MicroStrategy and Sally Beauty Holdings have also enjoyed upward momentum. MicroStrategy’s shares jumped 3% after Bernstein forecast significant growth potential with a target price increase to $600. Meanwhile, Sally Beauty advanced nearly 3% following an upgrade from TD Cowen, who noted its strong free cash flow and appealing valuation as key reasons for the upgrade. Additionally, Santander’s bank stock gained 2% due to an upgrade from Morgan Stanley, which cited the firm’s robust capital generation capabilities as a positive sign for its future.

Today’s premarket trading showed a mix of strong earnings surprises, critical upgrades, and underlying concerns that investors must navigate carefully as they seek opportunities in the current market environment.