The recent announcement of SoftBank’s $2 billion investment in Intel reveals an intriguing, yet arguably desperate, attempt to rekindle the embattled semiconductor titan’s trajectory. While this substantial sum appears to provide a glimmer of hope, it raises questions about the company’s long-term viability. SoftBank’s move may signal confidence in Intel’s future potential, but it also underscores the firm’s ongoing struggles to adapt swiftly to the fast-paced, high-stakes world of advanced chip manufacturing and AI-driven markets.

By acquiring a significant stake, SoftBank positions itself as a key player in shaping Intel’s destiny. However, mere capital infusions are insufficient if fundamental issues—like innovation stagnation and failure to capitalize on the AI boom—remain unaddressed. The gesture, while symbolic of support, feels akin to a financial respirator rather than a cure, especially given Intel’s tumultuous past year where its stock hemorrhaged 60%. A band-aid might provide temporary relief, but unless Intel manifests a clear, aggressive pivot towards market leadership, this investment may not be the turning point many hope it to be.

A Strategic Bet on U.S. Semiconductor Sovereignty

The geopolitical implications of this investment are palpable. Intel’s positioning as the only American company capable of manufacturing cutting-edge chips has made it a focal point in U.S. industrial policy debates. State intervention, including discussions of a possible government stake, suggests that Intel’s survival is now intertwined with national interests in R&D sovereignty and technological independence.

From a political viewpoint, this investment aligns with a pragmatic center-right ideology that values strategic industry revitalization through private sector engagement, but remains wary of overreliance on government intervention. Supporting Intel’s growth, especially as it becomes a pillar of U.S. technological independence, makes sense for policymakers who favor private-led innovation but recognize the necessity of strategic acuity in safeguarding national security and economic strength. Nevertheless, the ongoing uncertainty around Intel’s future profitability and its elusive ability to secure significant foundry customers cast shadows on this optimism.

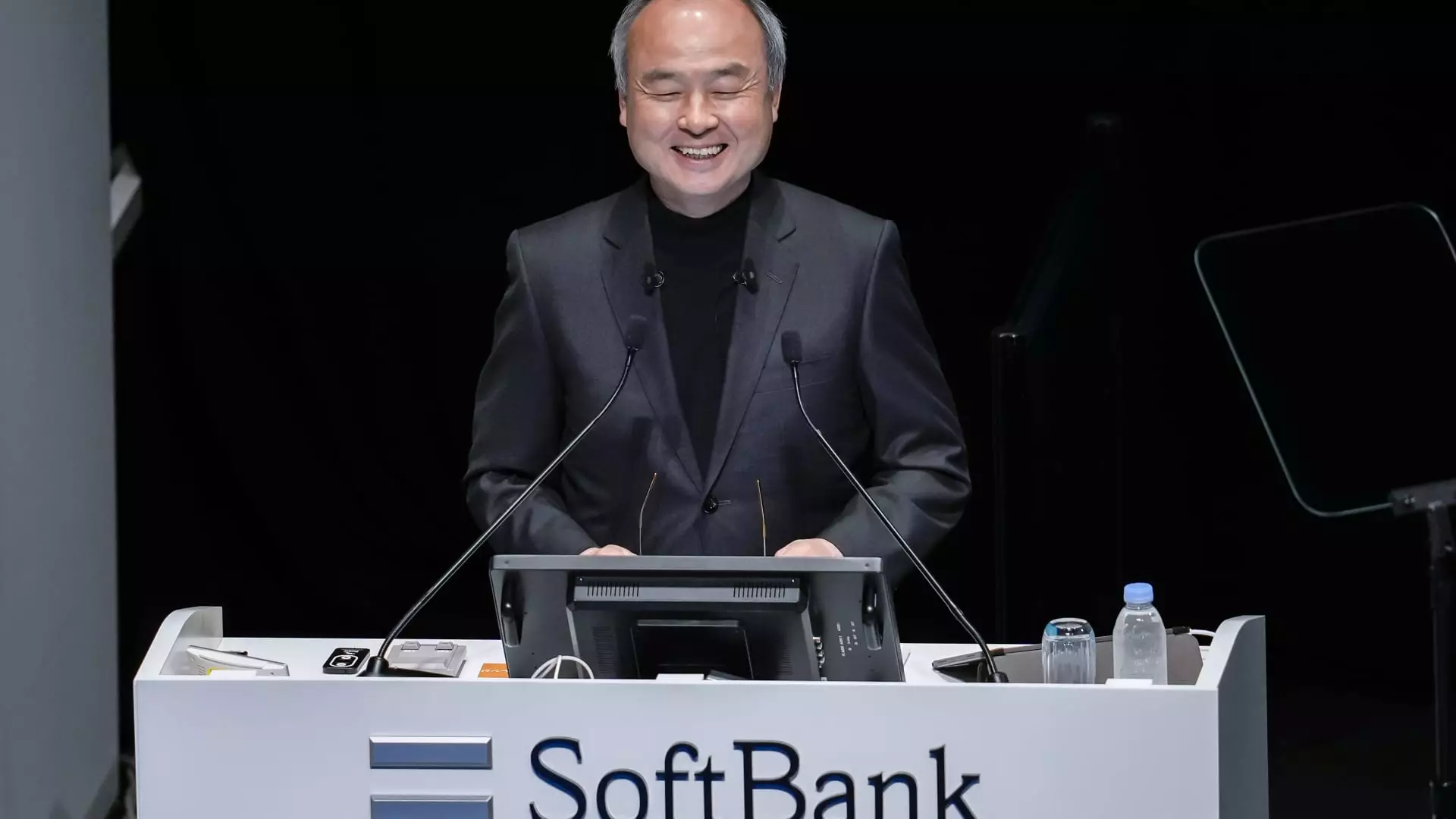

SoftBank’s Rise and the New Power Dynamics

SoftBank’s expansion into the chip sector, exemplified by its recent investments—most notably in Arm and Ampere Computing—indicates a strategic shift toward dominating not just AI, but the infrastructure that supports it. Unlike traditional investors, SoftBank’s willingness to pour billions into AI and semiconductor infrastructure demonstrates a forward-looking approach that centers on agglomerating market power and technological influence.

While this aggressive stance positions SoftBank as a formidable force in shaping the future chip landscape, it also raises concerns about market concentration and the dangers of monopolistic tendencies. For Intel, battling against this well-capitalized juggernaut means not only reimagining its product lines but also navigating a landscape where chip manufacturing and AI development are becoming prime battlegrounds for geopolitical and corporate supremacy.

From a pragmatic, center-right perspective, encouragement of private-sector innovation—like SoftBank’s—is vital, but it must be balanced by safeguarding competitive markets and preventing unchecked monopolies. SoftBank’s assertiveness emphasizes the shifting power dynamics in the global chip race, and Intel’s survival hinges on its ability to adapt quickly or risk being eclipsed by more agile, heavily financed entities.

The Road Ahead: Can Intel Turn the Tide?

Despite the injection of capital, Intel’s core challenges loom large. The company’s failure to secure significant clients for its foundry business exemplifies its difficulties in transforming promise into profit. The transition from a silicon device innovator to a manufacturing powerhouse has not gone smoothly, and leadership instability—marked by the recent change in CEO—further complicates matters.

However, the investment from SoftBank could serve as a catalyst if it prompts Intel to sharpen its strategic focus on securing high-profile customers and accelerating its manufacturing capabilities. Both companies seem to recognize a shared interest in maintaining U.S. dominance in semiconductor manufacturing, especially amid rising global tensions and supply chain vulnerabilities.

But will this partnership be enough? Skeptics argue that unless Intel fundamentally accelerates innovation and builds a resilient, competitive foundry ecosystem, SoftBank’s wager might end up as just another costly gamble—an expensive distraction rather than a meaningful revival. For Intel, survival may depend less on external injections of capital and more on internal reform, bold leadership, and decisive action to reclaim technological ground lost over the past decade.