Recent developments within the Federal Reserve have illuminated a disturbing trend: the emergence of increasingly radical dissenters who threaten the stability and credibility of the central banking system. Stephen Miran’s unexpected call for a half-percentage-point rate cut—double what the consensus suggests—signals a dangerous shift toward aggressive monetary policy maneuvers rooted more in political alignment than in economic prudence. Miran, a newly confirmed member aligned with the Trump administration’s political ambitions, exemplifies a broader concern: the politicization of the Federal Reserve. His audacious stance, diverging sharply from colleagues who favor measured, cautious moves, risks destabilizing an already fragile economic landscape.

This divergence isn’t merely about disagreement; it’s emblematic of a dangerous narrative where monetary policy is tailored to short-term political gains rather than long-term economic health. Miran’s push for more aggressive rate cuts suggests he may be influenced by external pressures, particularly given his appointment shortly after the Trump administration’s overt interference in Fed appointments. Such behavior undermines the independence essential for a central bank tasked with safeguarding economic stability from political meddling. When policymaking is driven by partisan interests, the odds of causing inflationary spirals or stunting economic growth increase significantly. The Fed’s credibility hinges on its perceived neutrality—a principle increasingly under threat.

The Political Puppeteering of the Federal Reserve

The appointment of Miran, a loyalist linked to the Trump administration, raises serious questions about the central bank’s autonomy. His known stance advocating for even more aggressive rate cuts in 2025 and beyond could be driven by political motives rather than genuine economic need. This pattern echoes concerns that have long surrounded the Fed: that its decision-making surface is increasingly influenced by the whims of the political elite, compromising its ability to act as an impartial guardian of the nation’s financial health.

Such politicization is dangerous. When a governing body like the Fed is seen as a political extension rather than a neutral arbiter, it erodes public confidence. Investors—who rely on predictable, data-driven policies—may become wary of unpredictable swings rooted in electoral cycles or partisan interests. Miran’s apparent alignment with President Trump’s outspoken demands for a significant rate reduction further amplifies these fears. His bold, unconventional dissent hints at a broader trend: that the Fed might prioritize short-lived political victories over prudent economic management. Such a strategy risks creating financial volatility, undermining the very stability the Fed seeks to uphold.

The Path Forward: Risks of Cherry-Picking Economic Outcomes

The broader implications of Miran’s stance—and the accompanying political interference—are profoundly concerning. A policy environment characterized by excessive rate variability, driven by unorthodox dissenters, invites economic uncertainty. Markets thrive on consistency and transparency; when these pillars are compromised, investor confidence takes a hit. Miran’s push for a more aggressive rate cut raises questions about whether the Fed is prioritizing immediate political appeasement over vigilant, data-driven policymaking.

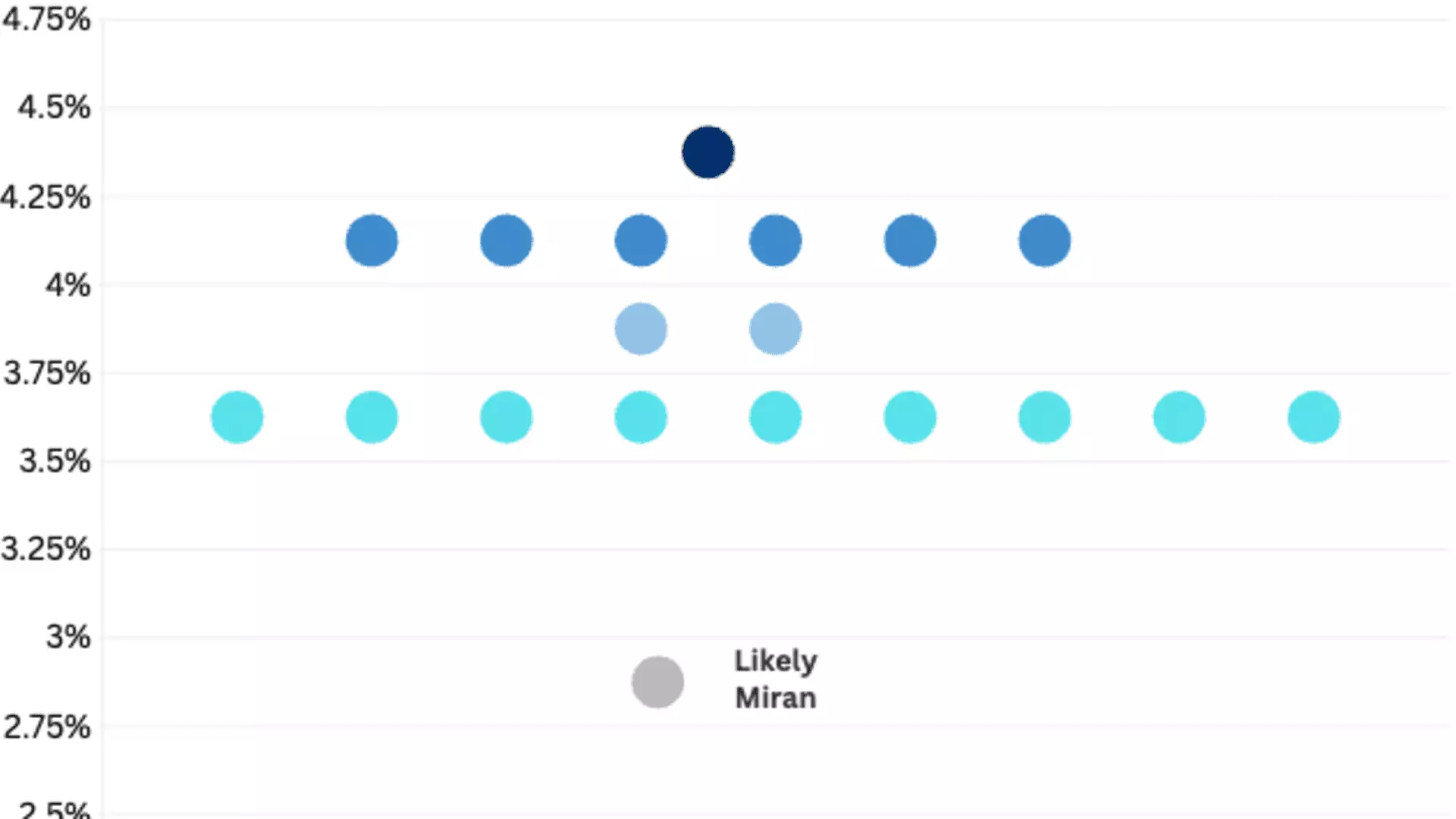

Moreover, the discord within the FOMC’s “dot plot”—a visual projection of the committee’s rate expectations—reflects an internal power struggle that weakens the institution’s unified voice. When some members see as many as four rate cuts in 2026, while others resist such measures, it creates a climate of unpredictability. This internal discord, amplified by external political influences, risks generating real economic damage: rising inflation if cuts are too aggressive, or stagnant growth if they are too cautious.

Additionally, Miran’s controversial appointment amid ongoing legal battles over the President’s authority to dismiss certain Fed officials highlights the fragile interplay between politics and monetary policy. It signals a future where the independence of the Fed is increasingly compromised, putting economic stability at the mercy of electoral interests. If these trends continue, the delicate balance of monetary policy could be permanently tilted, favoring short-term political gains over long-term economic resilience.

The reality is stark: when central bank decisions become hostage to political pressures, the economic well-being of millions hangs in the balance. Miran’s dissent is not merely a personal stance but a symptom of a larger, troubling shift toward politicized policymaking—one that could reshape the fabric of American economic policy in ways that benefit no one in the long run.