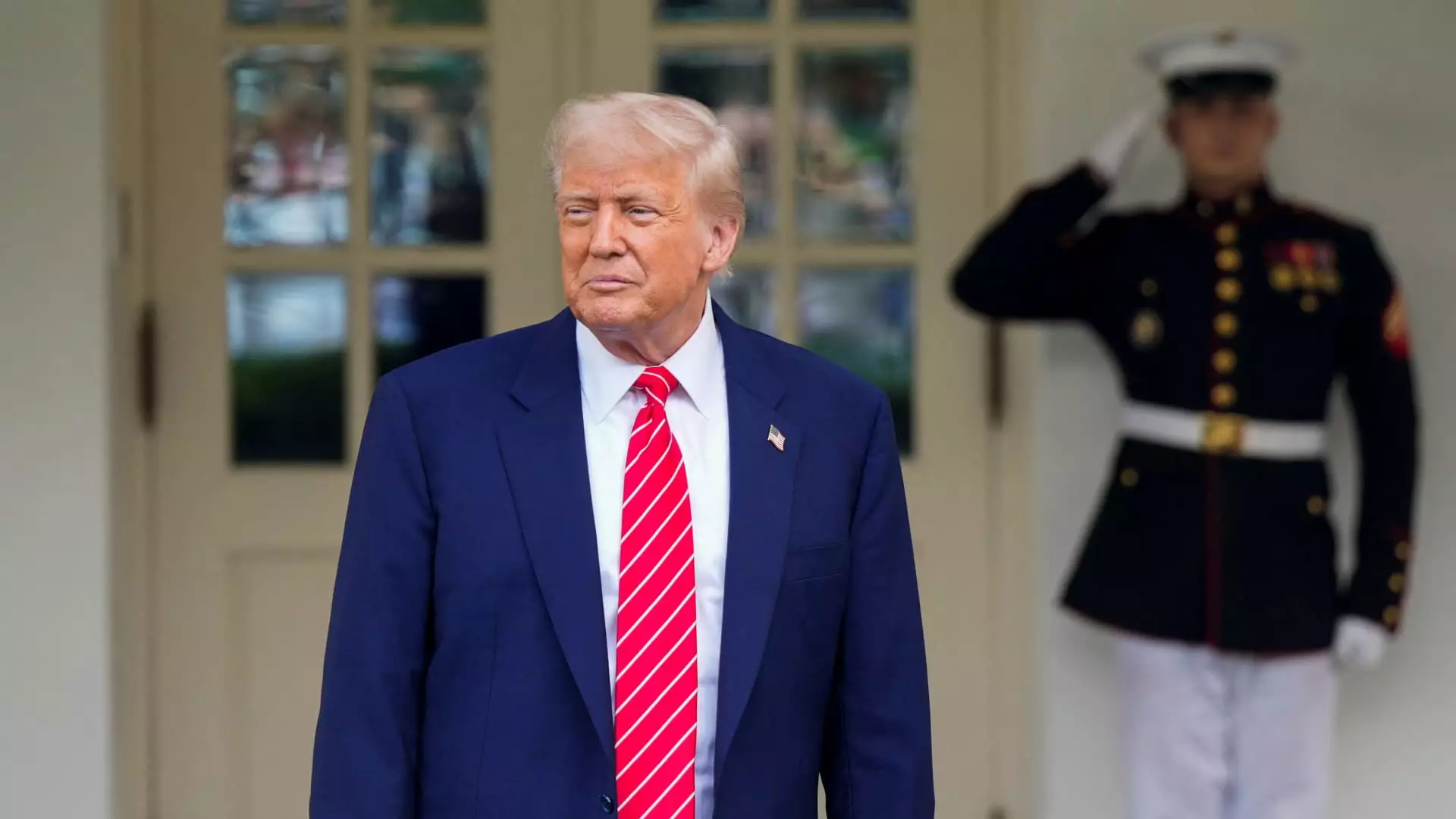

The current political landscape surrounding cryptocurrency legislation is undeniably tangled, but none more so than the inextricable connection to President Donald Trump. As lawmakers endeavor to set federal guidelines for stablecoins—digital currencies tethered to real-world assets like the U.S. dollar—Trump stands as a significant barrier to progress. This twisted scenario raises questions about ethical governance in a digital age fueled by personal profit.

With Trump’s foray into cryptocurrency through $TRUMP, his own meme coin, concerns have emerged that actually threaten the fabric of our democratic institutions. By intertwining his financial interests with policymaking, lawmakers are now compelled to navigate an ethical minefield, one that Democratic Senator Jeff Merkley succinctly termed a “profoundly corrupt scheme.” The impact on national security and public trust is palpable, creating an atmosphere where actual legislative progress becomes increasingly elusive.

The Fallout of Failed Legislation

The GENIUS Act, intended to create a robust framework for regulating stablecoins, was recently shot down in the Senate—48 for and 49 against—with the solution faltering far beneath the 60 votes needed for a path forward. This failure is not just a statistical anomaly; it’s a glaring symptom of the systemic dysfunction that is exacerbated by Trump’s vested interests in cryptocurrency. Democrats, fearing that any pact with Trump’s agenda could further enrich him personally, withdrew their support, even putting forward the “End Crypto Corruption Act” to sever the ties between elected officials and personal crypto ventures.

Senators who once championed the GENIUS Act retracted their support after re-evaluating the overarching implications of Trump’s financial machinations. The obstacle isn’t merely partisan gridlock—it’s a growing sense of moral obligation among lawmakers who fear being complicit in a scheme that they view as detrimental to both politics and the broader public. As one Senate committee member put it, “It’s unfortunate that personal business is getting in the way of good policy.”

Meme Coin Madness: A Dangerous Game

The rise of meme coins like $TRUMP, which has surged in value following attention-grabbing ventures like offering a dinner with the president, paints a sordid picture of influence-peddling that extends into the corridors of power. This isn’t just about a quirky digital asset; it’s about a manipulative system where political decisions can be swayed by financial entitlements. The optics of this are staggering, and as the First Lady Melania Trump chooses to endorse her own $MELANIA coin, one has to question the ethical ramifications that come with it.

Even critics from within the Democratic party are calling for investigations into these dubious financial ties, understanding that the personal pursuits of the president are undermining their legislative efforts. The once-promised “bipartisan win” on stablecoin regulation has become a twisted farce, with allegations of financial shadiness looming over every proposal.

The Broader Implications for Innovation

Ryan Gilbert, founder of a fintech venture fund, laments that Trump’s entanglements could spell trouble for the American innovation landscape. What’s increasingly clear is that as cryptocurrency continues its explosive growth, the U.S. risks being viewed as a laughingstock on the global stage. Investor confidence wanes when political figures are perceived to prioritize personal financial gain over the public good.

The growing influence of the crypto lobby—a power that rose under the shadow of the Trump administration—could have markedly positive implications for the industry if not entwined within Trump’s web of financial interests. As nations accelerate their efforts into blockchain innovation, the prospects for the U.S. remain teetering on the precipice of embarrassment.

A Call for Ethical Reassessment

What’s glaringly obvious is that the crypto landscape in America cannot thrive in its current state mirroring a circus of personal profiteering. Stronger regulatory measures devoid of conflicts of interest are crucial for fostering trust not just among lawmakers but also with the citizenry. While some moderately liberal voices transcend party lines to advocate for policy improvements, the singular focus of combating unethical influence must rise above partisan bickering.

It’s essential for lawmakers of all stripes to refrain from allowing Trump’s self-serving ventures to distract from the imperative of crafting thoughtful and effective legislation. The principles of democracy require that our elected officials utter a firm stand for public interest rather than personal wealth. Consider this the very test of American governance in the face of a rapidly evolving digital currency landscape.