The public spat between Tesla CEO Elon Musk and Peter Navarro, a prominent trade advisor, is not merely a personal vendetta—it reflects a troubling disjunction between the realities of innovative business operations and the policies being enacted at the federal level. As tariffs skyrocket on imported materials and parts, the impact on domestic innovators like Tesla is increasingly dire. Musk’s tweetstorm against Navarro is, in many ways, a cry for help from an industry leader who realizes that the government’s heavy hand threatens to stifle innovation and progress at a pivotal moment in history.

The tariffs imposed on advanced automotive manufacturing, which were touted as necessary for U.S. economic strength, inadvertently risk suffocating the very companies that drive technological advancement. While some argue that American jobs should take precedence, true progress hinges on the facilitation of free markets, where competition encourages innovation rather than snuffing it out. Tariffs, coming as they do, impose an extra burden on manufacturers, increasing production costs that ripple through the economy. In Musk’s case, he stands on the precipice of losing touch with the very values of innovation that made Tesla a household name.

Political Costs: A Clash of Titans

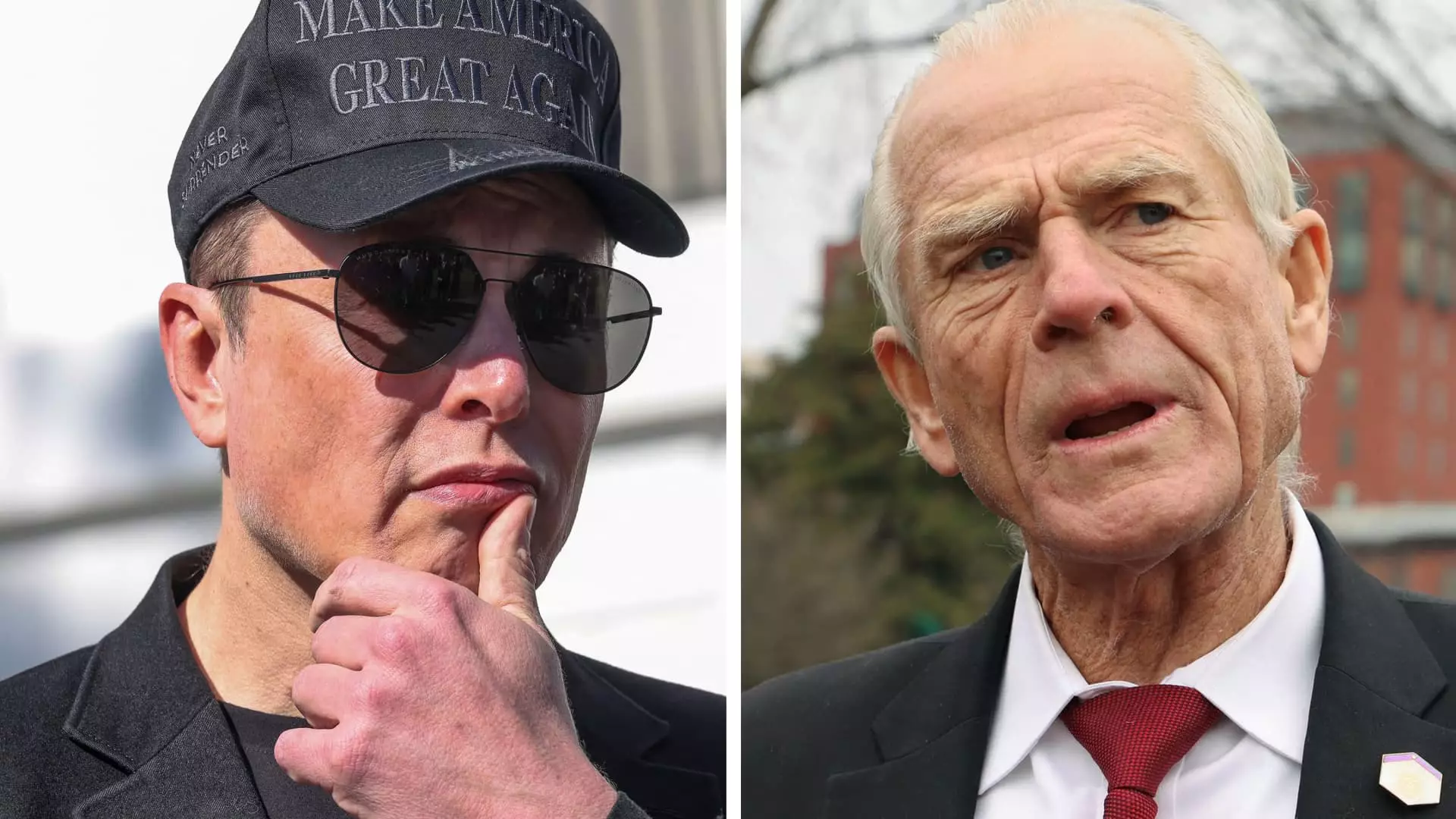

Musk’s barbs directed at Navarro expose a fascinating tension within Trump’s administration—one that has far-reaching implications for fellow entrepreneurs. The way Musk went after Navarro, calling him “dangerously dumb” and declaring, “a PhD in econ from Harvard is a bad thing,” isn’t just petty name-calling; it’s indicative of Musk’s exasperation with what he perceives as a lack of understanding of modern industry dynamics by policy makers. The disconnect is startling. Musk represents the American entrepreneurial spirit. On the flip side, Navarro embodies the traditional, heavy-handed government approach, which often overlooks the nuances of progress-driven businesses.

This clash raises the question: how can policymakers protect American jobs without obfuscating the path to innovation? The lack of coherent dialogue suggests that the administration is losing sight of how new companies can create jobs through innovation rather than regulation. Musk’s frustrations are echoed by many in the business community who fear that such policies will only hinder their ability to compete globally.

The Real Stakes: Tesla’s Financial Health and Volatilities

Deepening the narrative is Tesla’s staggering 22% stock drop over just four days. The company’s value has plummeted by over $585 billion, with significant repercussions for Musk’s financial health. For the CEO, these figures aren’t just numbers—they symbolize a profound shift in investor sentiment and market dynamics, which are further intensified by the tariff situation. As Musk and his brother Kimbal take swipes at Navarro, one can’t help but wonder whether such public confrontations are a desperate gamble to redirect the conversation and rally support in light of devastating business impacts.

Musk’s quest for a zero-tariff environment between Europe and North America further encapsulates the contradiction: while he’s navigating trade fraught with administrative chaos, he’s also advocating for a more open marketplace. This dilemma serves as a reminder that innovation doesn’t flourish under protectionism. The irony is rich; while Musk is advocating a traditional free-market philosophy, he is simultaneously at the helm of a company grappling with the fallout from government policy.

The Future of Tesla and the Perils Ahead

As we survey the landscape, we see a major player in the automotive industry now entangled in political mudslinging, facing not just market volatility, but also mounting criticism and operational challenges due to tariffs. Musk’s recent acknowledgments of these issues at international events underscore the urgent need for American companies to push for trade policies that encourage rather than inhibit growth.

What lies ahead is uncertain, but one thing is clear: the growing chasm between innovative drives and rigid policies threatens to reshape the American business landscape. Tesla’s fate interlocks with political fortunes, a reality that many in the tech and manufacturing realms might find increasingly disheartening. For Musk, the complexity of modern business necessitates an understanding that transcends textbook economics. And with self-made titans like him increasingly at odds with policymakers like Navarro, the American entrepreneurial spirit faces perhaps its most existential test yet.